What does the future hold for car ownership and the traditional car sales model? It’s a highly debated subject that continues to divide the automotive community. Some forecasts suggest that the bulk of passenger miles will be served by transport as a service (TaaS) providers—with customers accessing vehicles only as and when required.

Another line of thought says that this doomsday for the automotive industry will never happen. It points to car ownership as one of the most significant symbols of individual status and mobility, that will never go away.

Whichever side of the fence you sit on, it’s clear that some form of change in the automotive industry is afoot. In this article, we’ll be exploring this shift, what’s behind it and what the future holds for automotive OEMs.

Gen Y, Gen Z & Car Ownership

For context, it’s important to consider the influence of younger generations on, not just the automotive industry, but attitudes as a whole. In its landmark Global Automotive Consumer Study, Deloitte identified huge disparities between Gen Y (millennials) and their older counterparts when it came to vehicle ownership. Millennials put price, flexibility and convenience over everything else and are far more willing to embrace car-sharing/pooling services that require less commitment.

This generation has also grown up in an app-first world and this tech-savviness has fuelled the growth of car sharing/pooling apps the world over. Household names like Uber, Car2go, DriveNow and Zipcar are being joined by new players to the market, eager to capitalise on these mobility preferences.

Urbanisation

Along with a changing demographic, there’s also been a substantial shift in where we live. By 2030, 60% of the world’s population is expected to live in urban areas (compared to just 30% in 1950). And the trend is growing exponentially.

As the number of megacities grows, the on-demand nature of TaaS services becomes more popular and convenient. After all, megacities weren’t built for today’s vehicle numbers and their infrastructure is under huge strain. To combat this trend and to strive to make cities more liveable, car numbers have been limited via a number of methods: increased parking charges, park & ride, congestion fees and limiting entrance based on number plate. In the majority of large cities, having your own car is not necessarily cheaper, easier or more convenient. In some respects, having your own car is now actually more of a burden.

In any major city, you’re able to order a ride at the swipe of a phone screen. Everyone in an urban area has access to readily available road transport without ever having to actually buy a car. The push from cities (and smart cities) is towards sharing, pooling and eventually wide-scale introduction of automated vehicles. This urban phenomenon will transform how we view and perceive car ownership. Could it be that in 30 years, we’ll look back at 2020 and wonder why we all drove around in our OWN cars? Who knows, but all the indications point in that direction, including this report from the think tank RethinkX:

By 2030, within 10 years of regulatory approval of fully autonomous vehicles, 95% of all U.S. passenger miles will be served by TaaS providers who will own and operate fleets of autonomous electric vehicles providing passengers with higher levels of service, faster rides and vastly increased safety at a cost up to 10 times cheaper than today’s individually owned (IO) vehicles.

RethinkX – Rethinking Transportation 2020-2030

A Subscription Society

Thinking again about the modern-day customer’s preferences, subscription models are leading the charge. Spotify, Netflix, Amazon Prime, Hello Fresh, Dollar Shave Club, the list goes on. Subscription services have exploded in popularity thanks to their flexibility. You’ve finished all the Netflix shows? Then you can simply cancel it, without having to worry about hidden charges or extra commitment. Particularly when thinking about the younger customer demographic, this model suits their habits to a T. And it begs the question: What about Netflix for cars?

Depending on the specific subscription arrangement, customers get access to a range of cars along with insurance, breakdown cover and roadside assistance all at one fixed price. Not only does that allow customers to personalise their days—e.g. upgrading to a convertible sports car for a special occasion—but it gives them the driving experience without ever having to take out a 10 year loan to pay off their new car. This type of model is already operating around the world with examples such as Carro’s new subscription offering in Singapore and Carbar in Sydney. And then there are many OEM subscription models on the market right now: Access by BMW, Care by Volvo, Carpe by Jaguar Land Rover and Nissan Switch to name but a few.

Whichever way you slice it, how we experience road travel and how we define car ownership are changing beyond recognition. So where does that leave the automotive retailers and OEMs of the future?

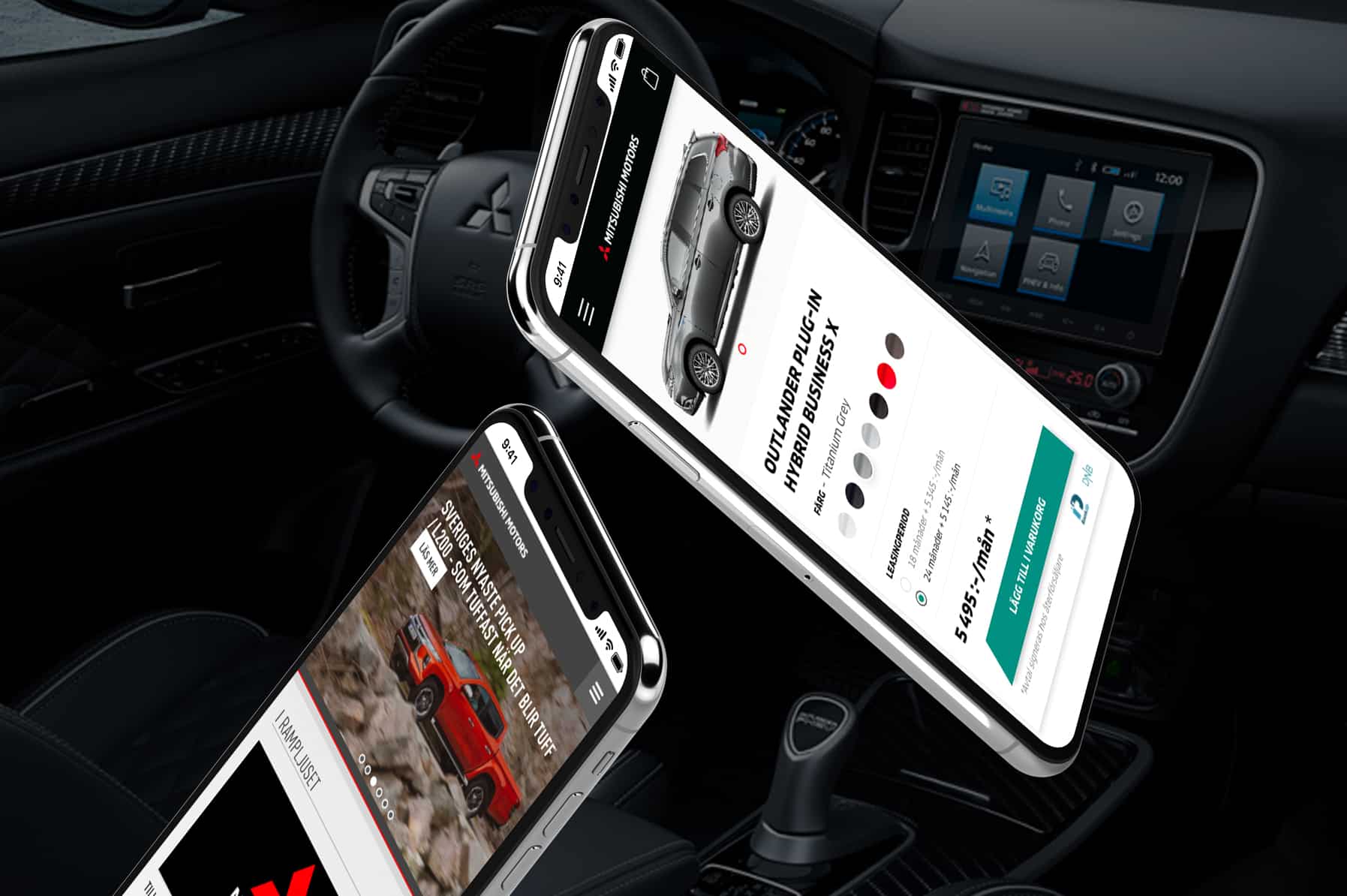

Discover how we launched SC Motors’ Mitsubishi Privatleasing where customers can visualise and configure their new car online through an easy-to-use purchasing funnel.

Move with the customer

As discussed, the extent to which private car ownership will become extinct is up for debate. But it’s clear that a new model of vehicle use is in sight. And this presents challenges for OEMs in knowing how to prepare for the unpredictable. As customers’ expectations continue to evolve and the technology around smart cities matures, OEMs will need to adapt and take action.

Standing still and hoping for the best just simply isn’t an option.

In a shared economy, it may get to a situation where customers choose whatever vehicle happens to be readily available, rather than wanting a specific vehicle. As a result, OEMs will need to differentiate themselves and come up with new initiatives/products to build brand awareness and nurture brand advocates. These may not be directly related to automotive per se but in other supporting areas that will help customers develop a relationship with the brand. Ultimately, OEMs will need to become translatable. It’ll be those that are willing to embrace a new direction and leave past glories behind them that will benefit the most.

Remember when Amazon only sold books? What about now? You can get just about everything you’ll ever need from Amazon.com. Then there’s Dyson, which started out selling vacuum cleaners and now produces hairdryers, hand dryers and air purifiers. And let’s not forget Apple, which started out as just a desktop computer… The point being, OEMs will need to ride the wave of digital transformation in the automotive industry and capitalise on the opportunities that are appearing. All the while, they’ll need to continue adapting to the modern-day customer’s needs.

“To compete with new market players, OEMs and dealers must adopt a sales structure that enables them to satisfy the demands of tomorrow’s customers – price transparency, seamless customer journeys, and fast delivery – while preserving their vast regional presence that gives them a true competitive advantage.”

Accenture – The Future of Automotive Sales

Think mobility (not just ‘car’)

The successful OEM of tomorrow will need to diversify their portfolio to match changes in car ownership and usage. They’ll need to build personal relationships with users through their brand values and presence, and two-way communication. One way of considering this is focusing on the term ‘mobility’ as opposed to ‘car’ or ‘automotive’.

We know that vehicle ownership is becoming less of a priority for younger generations. So the age-old question, “What car do you drive?” becomes, “How can I get from A to B in the quickest and easiest way possible?”

And to entice customers to their vehicles (when customers have no preference), OEMs will have to refocus their efforts to drive brand engagement. Some are already diversifying their offering beyond that of a traditional automotive OEM.

Let’s take the case of BMW. Here are just some of the initiatives it has launched to better connect with its customers and reach new audiences:

- The DriveNow car sharing mobility concept

- The ChargeNow mobility service for electric vehicle charging

- The ParkNow smart parking solution

- BMW and Artsy joint city guide within the Artsy app

These all have one thing in common—they’re nothing to do with selling cars.

For an automotive OEM, that might seem like an absurd concept. But as we’ve seen, the landscape is changing and OEMs need to adapt to stay relevant and competitive.

In the face of a disrupted industry, advancing technologies and fickle customers, it’s this emphasis on nurturing relationships that will drive future success.

At Vaimo, we’ve partnered with automotive OEMs and retailers to help them navigate the tricky waters of a changing external landscape. Would you like more advice on this topic?